What is the difference between “Federal” Disability Retirement and “OPM” Disability Retirement?

Although some people may confuse “Federal” Disability Retirement to mean “Social Security” Disability Retirement (SSDR) because this latter benefit is a type of retirement program administered by a U.S. Federal agency, that is, the Social Security Administration (SSA) — nevertheless, most of the time “Federal” Disability Retirement actually refers to “OPM” Disability Retirement. OPM is the acronym which stands for the U.S. Office of Personnel Management, and many Federal lawyers and employees choose to use this term to differentiate it from SSA’s disability program — the Social Security Disability Retirement, which is also known as Social Security Disability Income (SSDI).

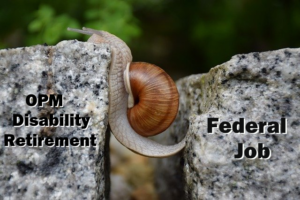

Thus, Federal Disability Retirement and OPM Disability Retirement are basically the same disability program. OPM Disability Retirement is a disability retirement plan available to Civilian Federal employees. It allows a Federal employee to retire earlier than “regular” retirement if an injury or medical condition prevents the Federal employee from performing the main work tasks of the Federal position he or she was hired for. These physical or psychiatric medical conditions should be expected to last one year or longer.

What is the difference between “FERS” Disability Retirement and “CSRS” Disability Retirement?

Federal Employees Retirement System (FERS) and the older Civil Service Retirement System (CSRS) are the names of two sets of U.S. Codes, rules and regulations that together dictate the laws and benefits that Civilian Federal employees will receive in the United States. Military personnel are covered by the VA Disability Retirement program, where “VA” stands for the United States Department of Veterans Affairs.

Both of these types of retirement programs, FERS and CSRS, are also part of the OPM Disability Retirement program (e.g., all FERS Disability Retirement claims are also OPM Disability Retirement cases, but a particular OPM Disability Retirement claim may or may not also be a FERS Disability Retirement case), but basically the difference has to do again with the set of Federal employee laws you were hired under. Almost all Federal employees hired after December 31, 1983 are automatically covered by FERS. Thus, in practice and in most cases, when a Federal Lawyer or a Federal Agency’s Human Resources Specialist talks about FERS Disability Retirement, he or she will typically be talking about OPM Disability Retirement. The term FERS Disability Retirement is thus more specific, but since most Federal employees today are covered under FERS rules, we often use them as synonyms, too.

What is the difference between OPM “Regular” Retirement and OPM “Disability” Retirement?

OPM Regular Retirement is when a Federal or Postal employee retires from Federal Service due his or her age and years of Civil service. As noted before, Federal Disability Retirement is a medical-based retirement available for FERS and CSRS employees. However, this medical condition or “disability” does not have to be total disability as it is the case of Social Security Disability Retirement cases.

The medical condition must be expected to last a minimum of a year. The illness or injury should be categorized as “chronic” in the sense that it won’t allow the Federal employee to work very well (technically the medical condition will not allow the employee to perform the basic “essential elements” of the job he or she was hired for by the Federal Agency). From our own experiences, most former Federal employees who are now under disability don’t even consider themselves to be disabled or incapacitated.

Perhaps this is a psychological self-defense mechanism, but it is a fairly accurate simplification that describes the self-image of many Federal disability retirees now happily working in different jobs and even living overseas. There are more technical definitions we can explain here but for now these simple explanations will suffice.

What is the difference between OPM Disability Retirement and Federal Workers Comp?

The Federal Employees’ Compensation Act (FECA) Program is an entirely different program which assists Federal employees and Postal workers who have sustained work-related injuries or diseases by providing them financial and medical benefits and help them to return to work. Federal Workers Compensation benefits are considered to be a short- and medium-term disability program. In other words, “OWCP” benefits (from the Office of Workers’ Compensation Programs within the Department of Labor) are not supposed to be a disability retirement program.

A key difference is that in OPM Disability Retirement, the qualifying medical condition can predate your first day of Federal employment. Under OPM Disability Retirement rules, the qualifying medical condition doesn’t have to be job-related, either. For instance, if you are a Mail Carrier and your eyes get hurt playing golf while vacationing in the Bahamas, and as a result of this accident, you can’t permanently drive your Postal vehicle safely anymore, then even though you will not qualify for OWCP benefits, you may still qualify for OPM Disability Retirement.

Another difference is that while most Federal and Postal employees are usually aware of the existence of Workers Comp or FECA disability benefits, at the same time, many of them have never heard of such a thing as “Federal Disability Retirement benefits”. Many tend to confuse it with Social Security Disability Retirement. Also, even when they are aware of this OPM disability program, they tend to believe that this program is administered by their own Agency or by the U.S. Postal Service. This is not true, either. Federal employees are not at the mercy of their employing Federal agencies.

How hard is to get Federal Employee OPM Disability Retirement?

This is a very general question, and the answer really depends not only on your specific Federal position (on the basic positional duties of the job you were hired for by your Federal Agency or the U.S. Postal Service), but it also depends upon your particular physical or psychiatric condition and the nature of your medical limitations. Most Federal Disability Retirement Attorneys would argue that the general requirements of OPM Disability Retirement are easier to meet than those of the VA and even the SSA. This is true in almost all medical cases, but a potential difficulty to qualify for OPM Disability Retirement may arise due the fact that most doctors are not readily familiar with the legal criteria necessary to write a useful medical opinion. In fact, all they will usually do is just to fill out forms without knowing what they need to legally prove. In the end, you may end up being considered to be “disabled” — and yet your OPM Disability Retirement application can still be denied.

I only have only “X” years of Federal Service, do I qualify for Federal Disability Retirement?

If you are a CSRS employee, you will need 5 years of creditable Federal Service to qualify for disability Retirement. However, Federal employees covered by the FERS system need only 18 months of Federal service to qualify for OPM Disability Retirement. If you are not sure which retirement system you were hired under, the general rule is that if you were hired after 1983, you are a FERS employee.

In many typical situations, older Federal employees with many years of public service will be able to qualify for either “regular” or “disability” retirement (in that case they should still consult with an OPM Disability Retirement attorney to help them to figure out which one will pay the more). Younger employees who suffer from a medical condition will not always be able to qualify for OPM Disability Retirement for several reasons. In such a case, many Federal agencies will typically behave unethically, hoping that the employee will just quit and leave the Federal Service empty-handed. This happens in many Federal agencies, but the U.S. Postal Service is especially guilty of this type of behavior.

I suffer from a specific medical condition, does this condition necessarily qualify for OPM Disability Retirement?

While there is not an “official” list of OPM qualified medical conditions (as it’s the case of SSA), you will be considered disabled under OPM Disability Retirement rules if your particular physical or psychiatric condition(s) prevent(s) you from continuing to perform efficient service in the Federal Service. So, in theory, it is not so much “what” your medical condition is, but “how” it interferes with the quality of your work performance. Even if you are accommodated but you can’t work efficiently, you may qualify for a Federal Disability retirement pension. That is basically the main idea with the original disability provisions under both FERS and CSRS laws.

Of course, in the “real world”, they would rather let you go empty handed. Therefore, in order to qualify for disability retirement, your treating physician will typically need to be familiarized with FERS and CSRS laws to fill out the proper OPM medical forms to help you to explain to OPM how your current medical condition will make you eligible for OPM Disability Retirement benefits. There are several legal and medical issues your primary health care provider should know to achieve this end. However, just to illustrate an example of a potential problem, if your primary health care provider doesn’t write that your particular physical or psychiatric conditions will be expected to last for at least one year, even if that is very obvious, your medical disability application will likely be defeated and denied.

Who approves or denies the Federal Disability Retirement application?

During the first two stages of the Federal Disability Retirement process, the Federal Agency responsible for reviewing your Federal Employee Disability Retirement application will be the U.S. Office of Personnel Management (OPM). If your “OPM” Disability Retirement claim is denied twice by OPM (First at the Initial Stage, then at the 2nd, or Reconsideration Stage), you will then need to file an appeal to the U.S. Merit Systems Protection Board (MSPB). In this Third Stage (the MSPB), OPM will cease to be the reviewer and will instead become the prosecutor. They will try very hard to stand by their decision. At this stage, it is strongly recommended that you hire an experienced Federal Disability Retirement lawyer.

There are many general practice attorneys and Federal employee “advocates” who will be willing to take your case up to the Third Stage of the Federal Disability Retirement process, also known as the MSPB stage, but in our opinion, it is better to hire an attorney experienced with this type of administrative laws right from the beginning. Unless you have an alternative future source of income (e.g., a golden parachute from a previous executive career in the private sector), you should spend time to prepare your disability retirement application well from Day One. If your application has already been denied twice, winning a disability claim with the MSPB will be a tougher call for several reasons.

At the Third Stage, your opponents will not just be Federal Disability Retirement “clerks” from OPM, but instead, you will be dealing with experienced OPM attorneys. Even if you decide to hire an experienced OPM Disability Retirement attorney to help you with your case at this late stage, he or she will still have a hard time refuting absurd arguments made by OPM’s legal representative, such as: “Oh, but your own medical documentation shows that you told your primary doctor you were feeling just fine on such and such dates”.

Can I get OPM Disability Retirement even if my Federal agency or the Postal Service has accommodated me?

In theory, Yes. This is because, technically, a “legal” accommodation is not the same as a light/limited duty accommodation. In practice, OPM clerks will deliberately ignore this fact; instead, they will argue that any accommodation provided by your Agency will constitute a legal accommodation. They might even argue that by signing the acceptance of a light duty job offer you were clearly stating that you were happily accommodated by your Agency. OPM Disability Retirement Attorneys who deal with these issues all the time should be able to prepare for you a strategy that will preempt this and other types of potential arguments OPM disability clerks and sometimes even OPM lawyers will try to use to defeat your Federal or Postal Disability Retirement application.

What will happen when I turn 62 years old?

Your “medical” retirement will be recalculated to become a “regular” retirement, and your annuity will be adjusted. The good news is that all of the years you were under “disability” retirement will count towards your future regular retirement (in some cases even the years you spent in the military, if it was bought back). For instance, if you worked for 10 years in the Postal Service, and you spend 20 years in Postal Disability Retirement, you will be credited for a total of 30 years for purposes of calculating your future “regular” OPM retirement.

How long does a FERS Disability Retirement benefit last?

Your OPM Disability Retirement annuity checks continue to show up on the 1st of each month in your bank statements until your 62nd birthday. After that date, you will no longer be considered a Federal Disability Retirement pensioner but a regular Federal employee retiree. So, in a way, these benefits will last forever (there are also some family survivor provisions). However, this is assuming that OPM will continue considering you to be “disabled” under their own rules. They will send you periodic medical questionnaires (unless you are also an SSDI recipient, in which case OPM will normally let the good folks at the SSA worry about these disability verification tasks). This is one extra reason why you should always keep up with your doctor’s appointments.

Can I get VA Disability Retirement and OPM Disability Retirement benefits at the same time?

Yes. There is no offset between the two. Veterans are able to receive both VA Disability benefits and FERS Disability Retirement annuity payments without any offsets or penalties for receiving both annuities. In this case, the Veteran can also opt to receive medical care from a VA health care center, Medicare from the SSA, and even a subsidized private FERS health insurance just like regular FERS employees do. Of course, opting out from some of these benefits may save the Veteran from paying premiums for duplicative benefits. It is therefore important that the Veteran understands all options available for purposes of future planning. Some mistakes can cost the retiree hundreds of dollars a month.

Can I get Federal Workers Comp and OPM Disability Retirement at the same time?

No. Keep in mind that OWCP DOL job-related disability payments are supposed to be temporary benefits only. Thus, what we recommend doing in most cases is to apply for OPM Disability Retirement benefits until OWCP cancels your benefits for good — or until you can no longer take all the harassment from the OWCP specialists and nurses in exchange for more money (OWCP does pay more than OPM Disability Retirement).

If you don’t file for OPM Disability Retirement and your agency officially separates you from Federal Service, you only have one year from the date of separation to file for Federal Disability Retirement benefits. If you fail to file within that timeframe, you will lose your right to file for Federal Disability Retirement benefits forever. This is yet another reason why you should take your OPM Disability Retirement preparation seriously. In this case, if you do qualify for OPM Disability Retirement and later OWCP decides to terminate their benefits, you can then activate your OPM Disability Retirement benefits.

Can I get a personal injury compensation claim with the Federal Government and OPM Disability Retirement at the same time?

Yes. Personal injury compensation payments, more correctly called Scheduled Awards under OWCP, is a lump-sum payment from the Federal Government to Federal employees, and these payments are available for certain injuries or medical conditions which are job-related. These cash awards are paid for injuries to specific body parts, such as an arm or a leg. They can be “scheduled” to be paid monthly for a certain period of time (e.g., two years), or they can be paid all together in an equivalent “lump sum” (most recipients choose the latter option).

Since there is no Statute of Limitations for Scheduled Awards, we recommend focusing your initial efforts on getting OPM Disability Retirement benefits. Once you get your OPM Disability Retirement approved — and in the process you also get back on your feet, financially speaking, it will be in your best interest to try and pursue a Scheduled Award claim, provided that your limb injury was already accepted as a job-related condition by Workers Comp (if not, you’ll need to talk to your doctor to establish the necessary connection). It is better to fight one battle at a time, and where and when you fight each battle is important for the ultimate outcome of the “war”.

Can I file for OPM Disability retirement and sue a Federal Agency for disability discrimination under EEOC rules?

Yes. However, in our opinion, EEOC claims are often very hard to prove. There seems to be a perception these days that discrimination occurs with great prevalence in the Federal Workplace, but never to you. Because an injury or illness has real, devastating financial effects on Federal employees, many Federal employees decide to use their limited economic resources on their best shot. Sometimes, you will also be required to find a mediator before any EEOC filing. Each case is, of course, different, but in general EEOC disability discrimination claims can be extremely stressful for Federal employees who are already suffering from one or (more often) several medical conditions.

Can I get OPM Disability Retirement and Social Security Disability Retirement at the same time?

Yes, but there will be an offset or reduction in the FERS annuity (as Social Security is primary, and the offset takes away from the FERS Disability Retirement annuity).

Besides the offset, there are several other considerations to keep in mind if you decide to file for both FERS Disability Retirement and Social Security Disability Insurance (SSDI). Please refer to the article Some Thoughts on Social Security and FERS Disability Retirement for more information.

How is OPM Disability Retirement calculated?

In the first year, your FERS disability retirement annuity will be calculated based upon 60% of your average of your highest-3 consecutive years of service, minus any Social Security Disability Insurance (SSDI) payments you might also be entitled to. After that, your annuity will be calculated using the 40% of your high-3 minus 60 % of your SSDI payment. Of course, if you don’t qualify for SSDI, there will be no subtraction or “offset”. At the age of 62, your disability retirement will become regular retirement with a new computation.

As a FERS Disability Retirement retiree, will I have to pay Federal income taxes?

Yes. OPM Disability Retirement income is taxable in the United States and its territories.

Will I be able to keep my subsidized health and dental insurance?

Yes. However, there might be some slight variations about what insurance companies are available and how much they will charge you. An advantage of receiving a subsidized FERS health insurance is that if you move overseas, some companies like Blue Cross/Blue Shield (no promotion intended) will allow you to use your medical insurance in other countries. This is in contrast to the benefits offered by the SSA in that if you choose to have Medicare, you won’t be able use that form of medical insurance outside the United States and its territories.

Can I work or start my own small business if I receive OPM Disability Retirement?

Yes. This is a case in which Federal Disability Retirement benefits differs with Federal Workers Comp. However, your new job must be outside the Federal Government sector. Also, keep in mind that if your earned income is more than 80% of what your former Federal position currently pays, you can lose your OPM Disability Retirement benefits for the year following the year you exceeded the 80% limit. If this happens, chances are that you will no longer qualify for regular retirement when you turn 62 years old. Thus, be careful with your future earned income. Most forms of “passive” income, however, do not count towards the 80% threshold.